Update:

In December 2019, Human Rights Watch published a follow-up report to Follow the Thread titled Fashion's Next Trend.

Since Follow the Thread was published in April 2017, there has been a significant increase in the number of companies that have published names, addresses, and other details of their tier-1 supplier factories. Building on our previous efforts, Fashion’s Next Trend takes stock of supply chain transparency as of late 2019, updates information from the 2017 report, provides an overview of positive new developments in the industry, and makes additional recommendations aimed at improving apparel companies’ due diligence practices on human rights. Annexes I and II of Fashion’s Next Trend will be periodically updated. Please refer to Annexes I and II for the most recently updated information about companies.

The coalition consists of Clean Clothes Campaign, Human Rights Watch, IndustriALL Global Union, the International Corporate Accountability Roundtable, the International Labor Rights Forum, the International Trade Union Confederation, the Maquila Solidarity Network, UNI Global Union, and the Worker Rights Consortium.

Related Content

Related Content

| Current/Anticipated Disclosure by December 31, 2017 vs. Pledge Standards | |||||||||

|---|---|---|---|---|---|---|---|---|---|

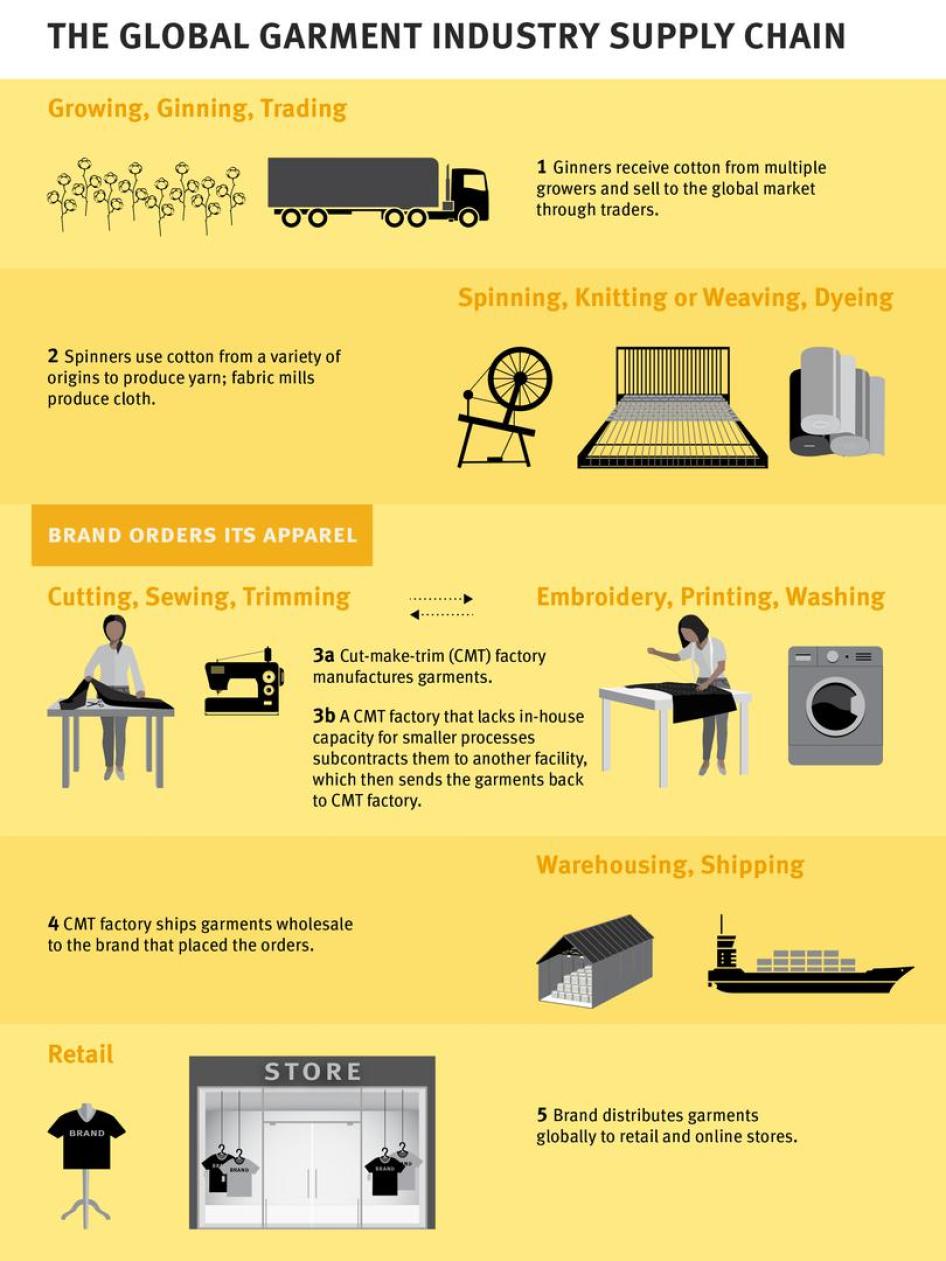

| Company | Headquarters | Published supplier factory--cut-make-trim (CMT) and subcontractor-- information prior to Pledge Letter? | Supplier factory information published meets or will meet Full Pledge by December 2017? | Names and street addresses of CMT factories and their subcontractors | Worker numbers | Product types | Parent company information | Frequency of disclosures | Time Frame to Implement Pledge |

| Abercrombie & Fitch | US | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of tier-1 factories (CMT for woven, denim, knit, sweater, intimates,and accessoroies) with country of manufacture, but without street address. | No | No | No | 2 times per year | 2017 |

| Adidas | Germany | Names of all tier-1 factories, including those used by licensees as well as authorized subcontractors, by country and city. Names of all tier-2 wet process suppliers, by country and city. Separate lists of supplier factories used for the Olympic Games. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| ALDI North and ALDI South | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but not their subcontractors. | No | No | No | 1+ times per year | 2017 |

| American Eagle Outfitters | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Arcadia Group | UK | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but disclosure of authorized subcontractors will need more time. | No | No | No | 1+ times per year | NA |

| Armani | Italy | None | No response to coalition letter. | No | No | No | No | NA | NA |

| ASICS | Japan | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| ASOS | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 6 times per year | 2017 |

| Benetton | Italy | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but not their subcontractors. | No | Yes | No | 1 time per year | NA |

| BESTSELLER | Denmark | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Company stated that tier-1 (CMT) factories will be published but did not provide more information about what precisely will be disclosed for each factory. | No information | No information | No information | No information | 2017 |

| C&A | Netherlands | Names and addresses of all CMT factories. Excluded: Brazil, Mexico, and processing factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Canadian Tire | Canada | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Carrefour | France | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Carter's | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Clarks | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | A vast majoirity of the supplier factory information will be published in 2017. Five percent of non-footwear accessories to be published in 2018. |

| Coles | Australia | Names and addresses of CMT factories, but not subcontractors. Company states that its supplier factories use minimal subcontracting. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of CMT factories, but not subcontractors. Company states that its supplier factories use minimal subcontracting. | No | No | No | 1 time per year | NA |

| Columbia Sportswear | US | Names and addresses of factories from which they directly source and any external subcontractors engaged to perform finishing processes (mostly limited to collegiate suppliers since the others have in-house capacity). | No additional commitments to meet Pledge standards; maintaining status quo. | Yes | No | No | No | 1 time per year | NA |

| Cotton On Group | Australia | Names and addresses of CMT factories used by top 20 suppliers. | Full Pledge alignment. | Yes | Yes | Yes | Yes | Multiple | 2017 |

| Debenhams | UK | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 factories which includes all CMT factories; some external processing such as embroidering and washing may not be included. | Yes | No | No | No information | 2017 |

| Decathlon | France | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Company did not provide more information about what precisely will be disclosed for each factory. | No information | No information | No information | No information | 2017 |

| Desigual | Spain | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| DICK'S Sporting Goods | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Disney | US | Names and addresses of all facilities part of Disney's vertical supply chain and any facility in its vertical supply chains where Disney intellectual property is located, which includes any laundry, printing, embroidery facility if Disney intellectual property is incorporated into that finished product or component. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of all facilities in its vertical supply chain, including subcontractors, where Disney intellectual property is located. | No | No | No | 1 time per year | NA |

| Esprit | Germany | Names and addresses of CMT factoriesand their authorized subcontractors. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Fast Retailing | Japan | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Published name and addresses of "Core Factories"producing for UNIQLO brand, representing 80 percent of the total volume of orders for UNIQLO brand. Plans to publish a list of GU's "major partner factories" in 2017. No clear commitment to publish subcontractors in 2017. | No | No | No | 1 time per year | 2017 |

| Foot Locker | US | Previously disclosed names and addresses for suppliers of collegiate apparel line that is currently inactive. | No commitment to publish current own-brand supplier factory information. | No | No | No | No | NA | NA |

| Forever 21 | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| G-Star RAW | Netherlands | Names, addresses, product types, parent company, and worker numbers for CMT factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Gap | US | Names and addresses of CMT factories and their authorized subcontractors. | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | Gap did not make any new commitments to align with the Pledge by December 2017. The company updated its supplier factory information to be more closely aligned with the Pledge. |

| H&M Group | Sweden | Names and addresses of supplier factories and vendors (suppliers), processing factories, and some fabric suppliers. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Hanesbrands | US | Names and addresses of collegiate suppliers and owned factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Hudson's Bay Company | Canada | Names and addresses of some, but not all, supplier factories. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of some, but not all, CMT factories. | No | No | No | 1 time per year | NA |

| Hugo Boss | Germany | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Inditex | Spain | CMT factories not published. Names and addresses of direct and indirect wet processing factories published. | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| John Lewis | UK | None | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| KiK | Germany | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Kmart Australia | Australia | Names and addresses of factories in "high risk" countries. | No response to coalition letter. | Names and addresses of factories in "high risk" countries. | No | No | No | No information | NA |

| Levi Strauss | US | Names and addresses of CMT factories and authorized subcontractors. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| LIDL | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 factories which includes all CMT, but does not include all processing facilities. | No | No | No | 2 times per year | 2017 |

| Lindex | Sweden | Names and addresses of CMT factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| Loblaw | Canada | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of all factories where they Òsource apparel and footwear directlyÓ with country of manufacture but not street address. | No | No | No | 2 times per year | 2017 |

| MANGO | Spain | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Marks and Spencer (M&S) | UK | Names and street addresses, worker numbers, gender breakdown, and product types. | Almost full Pledge alignment. M&S will continue with its Plan A disclosure commitments and add processing factories and also make its existing disclosure available in a searchable format. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| Matalan | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Mizuno | Japan | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names along with country of manufacture of "Core Suppliers," that is, 125 factories disclosed of 464 tier-1 suppliers as reported on Mizuno website. | No | Yes | No | No information | Began disclosure in 2017. |

| Morrison's | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Mountain Equipment Co-op (MEC) | Canada | Names and addresses of all CMT factories and some processing facilities. | Almost full Pledge alignment. | Names and addresses of all CMT factories and some processing facilities. | Yes | Yes | Yes | 2 times per year | Additional details for CMT factories to meet Pledge standards will be published in 2017. Names and other details of authorized printers will be added subsequently. |

| New Balance | US | Names and addresses of direct supplier factories, excluding US wholly-owned facilities. | Not full Pledge, but will add product type, and update annually in searchable format. | Names and addresses of direct supplier factories, excluding US wholly-owned facilities. | No | Yes | No | 1 time per year | 2017 |

| New Look | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | At least annual | 2017 |

| Next | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Nike | US | Names, addresses, product category, worker numbers, gender and migrant worker breakdown, and authorized subcontractor. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Patagonia | US | Names, addresses, product category, worker numbers, gender breakdown, and parent companies of CMT and authorized subcontractors. Some fabric suppliers indicated. One cotton farm also disclosed. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| Pentland Brands | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Primark | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Puma | Germany | Name of factory by country, city for tier-1 "core suppliers" and tier-2 material and component suppliers. | Almost full Pledge alignment for tier-1 "core suppliers" factories. | Names and addresses of tier-1 "core suppliers" amounting to 80 percent of their total business volume. But authorized subcontractors (if any) are not included in the definition of "core suppliers." | Yes | Yes | No | 1 time per year | 2017 |

| PVH Corporation | US | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of CMT factories along with country of manufacture but without street address. | No | No | No | 2 times per year | 2017 |

| Ralph Lauren Corporation | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Rip Curl | Australia | None | No response to coalition letter. | No | No | No | No | NA | NA |

| River Island | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Sainsbury's | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Shop Direct | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Sports Direct | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Target Australia | Australia | Based on information on its website, Target Australia appears to disclose the names and addresses of CMT factories. | No response to coalition letter. | Names and addresses of CMT factories appear to be disclosed. The coalition has no information about percentage of supplier factories disclosed or other exclusions, if any. | No | No | No | Company website says "regular basis." | NA |

| Target USA | US | Names and countries of CMT suppliers, textile and wet processing factories. | No additional commitments to meet Pledge standards; maintaining status quo. | Names of CMT factories along with country of manufacture but without street address. | No | No | No | 4 times per year | NA |

| Tchibo | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses for CMT factories. | Yes | Yes | No | No information | NA |

| Tesco | UK | Names and addresses of Bangladesh supplier factories only. | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| The Children's Place | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Under Armour | US | Only suppliers factories for collegiate apparel. | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses for all CMT factories (but not embellishers or subcontractors). | Yes | Yes | Yes | No information | Pledge details for CMT factories will be published in 2017. |

| Urban Outfitters | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| VF Corporation | US | Names of factories by country for all VF brands of all VF-owned and operated, and direct sourced, tier-1 supplier factories. | Not full Pledge, but will include street addresses to align more with the Pledge. | Names and addresses of all CMT factories but not those used by licensees and subcontractors. | No | No | No | Regular | 2017 |

| Walmart | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Woolworths | Australia | Names and addresses of all sites in Bangladesh are disclosed, and overall more than 40 percent of the supply chain (for apparel and footwear) is published. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of all sites in Bangladesh are disclosed, and overall more than 40 percent of the supply chain (for apparel and footwear) is published. | No | No | No | 4 times per year | NA |